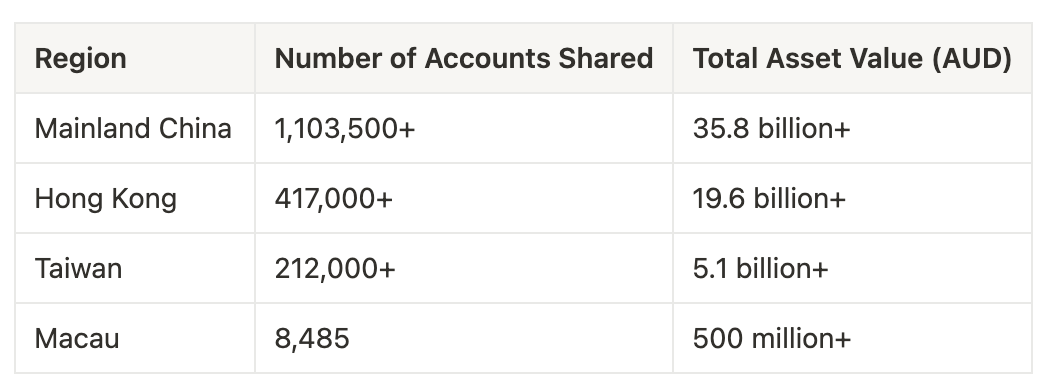

ATO Confirms: Over 1.1 Million Chinese-Linked Accounts Reported to Chinese Tax Authorities

According to the latest 2023 CRS (Common Reporting Standard) data released by the Australian Taxation Office (ATO), Australia has shared a substantial volume of financial account information with tax authorities in China — including Mainland China, Hong Kong, Macau, and Taiwan — sparking widespread concern. This article breaks down the implications and potential risks in three key areas.

What Is CRS, and Why Has My Information Been Shared with China?

The Common Reporting Standard (CRS), developed by the OECD, is a global framework for the automatic exchange of financial account information between countries. If you are considered a Chinese tax resident, even if you reside overseas, any accounts you hold in Australia are subject to annual reporting by financial institutions to the ATO, which then passes the data on to Chinese tax authorities.

The information shared includes:

- Full name

- Date of birth

- Tax Identification Number (TIN)

- Account number

- End-of-year account balances

- Interest income, dividends, and other investment-related earnings

China Tops the List Globally — Unprecedented Tax Exposure

Based on ATO figures submitted to the Australian Federal Parliament, over 1.1 million account records were shared with Chinese tax authorities in 2023, involving total assets exceeding AUD 35.8 billion — the highest of any country.

If you maintain Australian bank accounts but are still deemed a Chinese tax resident (e.g. household registration remains in China, or your family and economic ties are based there), this data may be used as evidence of your tax obligations in China.

Chinese Tax Authorities Are Taking Action — Offshore Income No Longer a “Safe Zone”

In recent months, tax authorities across several Chinese provinces — including Shanghai, Zhejiang, Hubei, and Shandong — have issued penalties for failing to declare overseas income. Some individuals were ordered to pay hundreds of thousands to over a million RMB in back taxes and late payment interest. This highlights that:

- CRS data is now a key part of China’s tax surveillance system

- If your account is reported, the Chinese Tax Bureau may launch an investigation

- Failure to declare overseas income can result in heavy penalties and damaged tax credit records

Professional Advice: Chinese Tax Residents with Australian Accounts Must Be Cautious

If any of the following apply to you, it is highly recommended to consult a tax or immigration advisor without delay:

- You reside in Australia but still maintain Chinese household registration, family, or property ties

- You hold Australian bank accounts or investments that earn interest, dividends, or capital gains

- You are unsure whether you have correctly declared your overseas income or tax residency status

- You are planning to transfer, gift, or place assets in a trust for family members abroad

CRS is a global trend, and the best way to manage your exposure is to stay compliant — not to take chances.

If you have any questions or would like professional assistance, please feel free to contact us at Riverwood Migration (Email: [email protected]). We are committed to providing transparent, expert migration services to help you achieve your dream of moving to Australia.